YS Jagan slams TDP's undemocratic assaults in MPP Election YSRCP flays coalition for double standards

YSRCP flays coalition for double standards Naidu shamelessly stealing credit for Bhogapuram airport: KK Raju

Naidu shamelessly stealing credit for Bhogapuram airport: KK Raju YS Jagan invited to 134th Urs of Hazrat Kale Mastan Shah Wali Dargah

YS Jagan invited to 134th Urs of Hazrat Kale Mastan Shah Wali Dargah Chandrababu lied on RLI; betrayed people of Rayalaseema

Chandrababu lied on RLI; betrayed people of Rayalaseema Restart Rayalaseema Lift irrigation works immediately; Naidu must answer for stalling the project

Restart Rayalaseema Lift irrigation works immediately; Naidu must answer for stalling the project YSRCP demands Chandrababu’s reply on RLI

YSRCP demands Chandrababu’s reply on RLI Coalition failed on all fronts

Coalition failed on all fronts Naidu betrayed Rayalaseema for personal gain: SV Mohan Reddy

Naidu betrayed Rayalaseema for personal gain: SV Mohan Reddy Chandrababu Naidu has written death warrant for Rayalaseema

Chandrababu Naidu has written death warrant for Rayalaseema

Top Ten Benefits Of Special Status

10 May 2016 1:16 PM

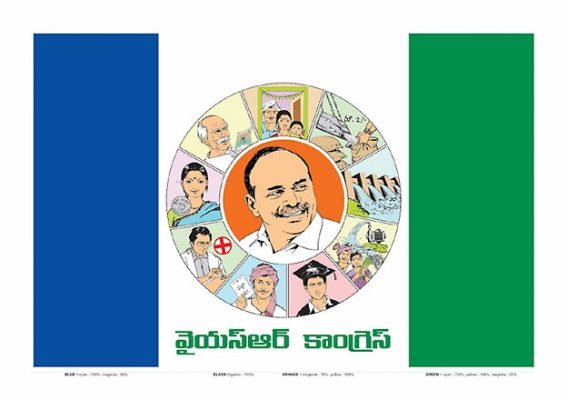

Hyderabad: YSRCP is staging agitation at the collectorates of all districts, wishing for special status for AP state. As part of it, dharna has been planned under the leadership of the leader of opposition and YSRCP president, YS Jagan at Kakinada of East Godavari district. YSRCP opines that special status is like 'Sanjeevani' the mythological wonder drug to the state of AP that has sufefred loss due to bifurcation. Let us now have a look at the top ten benefits ensured by the sanction of special status.

1) 90% of central grants will be available.

Good percentage in taxes, grants and loans will be available. A grant is something that does not need to be paid back while a loan has to be. To the states without special status, the centre does not give grants more than 30%. Whatever scheme or programme is taken up, 30% will be sponsored by the Government while the rest of the 70% should be taken as loan. With special status, 90% of the amount will be given as grant and 10% has to be borrowed.

2) Huge industrial discounts

Already 11 states of India have special status. They have benefited with discounts due to special status. They are enjoying huge industrial discounts.

3) Chandrababu's statement that special status and industrial discount are two mutually irrelevant topics is false. In the history of India, no state has enjoyed such huge discounts without special status. Chandrababu's deliberate release of wrong information is unfair.

4) Thousands of industries and resulting employment opportunities are possible only due to special status. Lakhs of people can find jobs due to the status.

5) Industrial units will have 100% excise duty exemption if special status is given. Income Tax exemption also will be given. Fright reimbursement also will be possible. Attracted by these benefits industries will prefer to establish their units in this state to the other states. lakhs of crores of rupees' expenditure also will reach the state. This will result in lakhs of jobs.

6) 30% discount will be given on the expenditure on plants and machinery. Along with newly-established industries, this will also apply to those industries which were established before the announcement of special status but are extending their establishment now.

7) 3% discount will be given on interest on working capital for establishment of industries. 50% discount will apply on power charges of the industries for not less than 20 years. These decisions will encourage aspiring businessmen within the state to set up industries. Medium scale and small scale industries will benefit from these discounts.

8) Special status will change the expenditure pattern in the arrangement of infrastructure creation for micro, small, medium and large scale industries. Central Government agencies like ONGC and HPCL may also come forward to set up units here.

9) Due to tax discounts, the cost of many things we buy may come down by half. If 100% tax exemption is available for goods produced, the people of our state may buy certain goods and commodities much cheaper than the people of other states.

10) With special status sanctioned, our water projects will be built by the centre. Accelerated Irrigation Benefit Programme (AIBP) of the central Government offers funds to the water projects in the states. If the states without special status receive grants from this programme, a maximum of 25-50% grants may be given. But for the states with special status, 90% of the funds will be born by the Government. The central Government will also bear the foreign loans related to externally aided projects. 90% of the loan will be given as grant by the centre. The interest on the loan also will be paid by the centre.

Due to all these benefits, YSRCP believes special status to be Sanjeevani to the state and is fighting relentlessly for attaining it.

ఇదే వార్తాంశం తెలుగులో: http://bit.ly/1QX2KVE